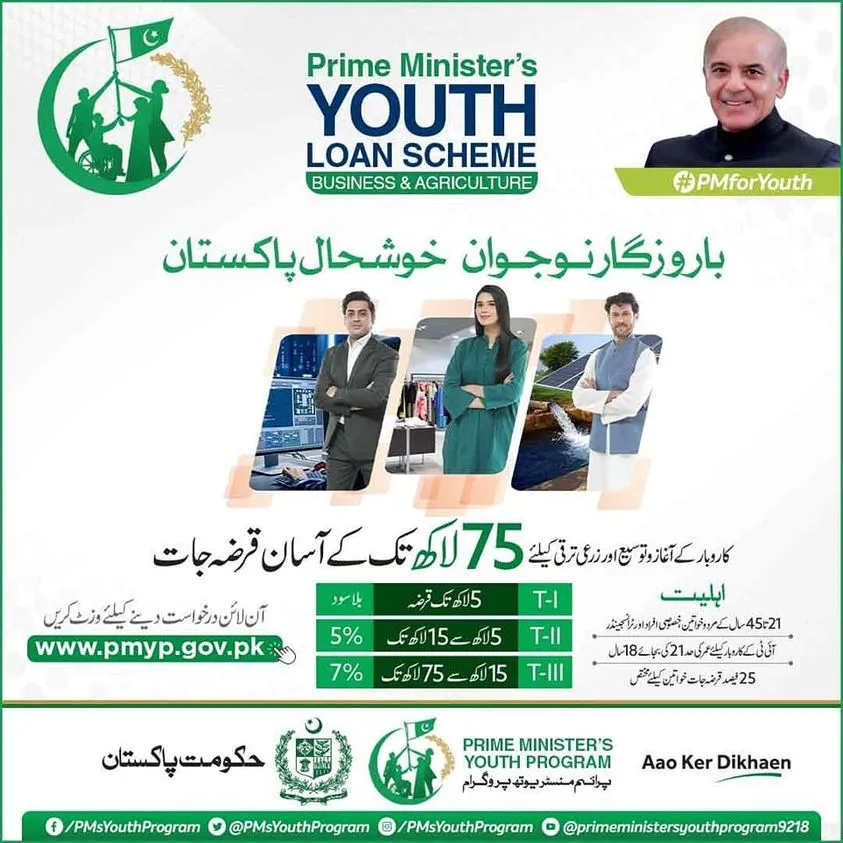

PM Youth Loan Scheme

On the instructions of the Prime Minister of Pakistan, Mian Muhammad Shahbaz Sharif, the registration of the PM Youth Loan Scheme has been started once again. Those who wish to get a loan can get a loan from 5 lakhs to 75 lakhs at a low markup after completing their registration. All Pakistani citizens between 21 and 45 years of age with a computerized National Identity Card can benefit from this loan scheme. In this scheme, 25 percent of loans have been allocated to women.

Loans available under the Prime Minister Youth and Loan Scheme have been divided into three tiers. Within the first tier, a loan of Rs 1 lakh to Rs 5 lakh can be obtained interest-free. Within the second level, a loan of Rs 5 lakh to Rs 15 lakh can be obtained, for which 5% interest has to be paid. Within the third level, the loan limit has been kept from Rs 15 lakh to Rs 75 lakh, for which 7% interest has to be paid.

Also Read: How to apply online for Punjab Bike scheme 2024?

PM Youth Loan Amount And Interest Rate

| Tiers | Amount Of Loan | Interest Rate Of Loan |

| 1 | 500,000 | 0% |

| 2 | 500,001-1,500,000 | 5% |

| 3 | 1,500,000-7,500,000 | 7% |

How To Apply Online For Loan?

If you want to complete your registration for the Prime Minister Youth Loan Scheme, here is the complete procedure for you. You can complete your registration very easily. Before completing the registration, it is very important for you to know the eligibility criteria, which are as follows:.

- Things you need to know to apply for the Prime Minister’s Youth Business and Agriculture Loan Scheme.

- Potential Entrepreneurship All citizens of Pakistan, including Azad Jammu and Kashmir and Gilgit-Baltistan, who have a national identity card, are between the ages of 18 and 45, and possess an entrepreneurial mindset, are eligible for this loan.

- A minimum age limit of 18 years and an education minimum of Matric are required for IT and e-commerce sector candidates.

- In the case of agricultural loans, the State Bank of Pakistan credit limit and terms and conditions for farmers will be applicable.

- 25% of the loans are earmarked for women.

- You must have an ID card to complete registration in this scheme.

Now, if we talk about registration, a button has been provided below for registration. You can get the registration form very easily by clicking on the button. And you can submit your application to get a loan.

Document Required For PM Youth Loan

To get a loan from the Prime Minister Youth Loan Scheme, you will need the following essential documents:

- National identification card

- Bank Account Details

- You must have a matriculation certificate to avail of an IT business loan.

Also Read: Punjab Rozgar Scheme Apply Online Latest Update 2024

Who are the people who cannot get a loan?

- Overseas Pakistanis cannot avail of these loans.

- Among such persons who are employed in any government sector, they also cannot avail of this loan.

- People who do not have a Pakistani identity card cannot also get a loan.

- Such persons who will physically visit the bank and use the application will be provided with this loan.

List of MFIs/MFBs For providing Tier 1 loans of PMYB & ALS

| S.No | Bank | MFIs/MFBs |

|---|---|---|

| 1 | Bank of Punjab | Akhuwat Islamic Microfinance National Rural Support Program (NRSP) |

| 2 | National Bank of Pakistan | NRSP Microfinance Bank Rural Community Development Program (RCDP) |

| 3 | Askari Bank | Akhuwat Islamic Microfinance |

| 4 | Habib Bank Limited | SAFCO Microfinance Company |

| 5 | Bank of Khyber | National Rural Support Program (NRSP) |

FAQ

Who is eligible for PM youth loan?

Potential Entrepreneurship All citizens of Pakistan, including Azad Jammu and Kashmir and Gilgit-Baltistan, who have a national identity card, are between the ages of 18 and 45, and possess an entrepreneurial mindset, are eligible for this loan.

What is the interest rate of prime minister loan scheme?

There is no markup for tier I; the markup rate for tier II is 5%; and the markup rate is 7% for tier III.

How much loan can one get from the PM Minister Youth Loan Scheme?

The loans provided under this scheme have been divided into three tiers. Within the first tier, a loan can be availed of from 1 lakh to 5 lakh, within the second tier from 5 lakh to 15 lakh, and within the third tier from 15 lakh to 75 lakh rupees.